March 24, 2023 By Carol Britton Meyer

Town Administrator for Finance Michelle Monsegur explained the five-year property tax impacts related to the proposed Fiscal 2024 $7.9 million override during Thursday’s Select Board meeting. The presentation will be posted on the town website Friday morning (March 24).

Voters at the April 24 Town Meeting will first vote on a $143.9 balanced municipal and school budget and then on the proposed $151.8 million level services override budget that is contingent on a majority vote of approval at Town Meeting and at the ballot box April 29.

The latter budget figure includes a $7.9 million operating override that would become part of the permanent tax base to cover a deficit in both budgets and that also includes $1.876 in additional requests.

The school budget comprises $65.7 million of the overall budget amount, not including the additional requests that were not included in the initial proposed level services budget — totaling $701,874. The town side of the budget also includes additional requests.

Without an override, a significant cut in the number of positions and services on both the municipal and school sides would result, with reductions going into effect July 1, 2023, according to town and school officials.

The override budget includes positions that were added during the pandemic — including more than 30 Hingham Public Schools staff — using one-time COVID relief funds and money from the town’s rainy day (reserve) fund.

The School Committee, Advisory Committee, and Select Board recently unanimously supported the creation of a Fiscal 2024-2028 memorandum of understanding that constitutes a “public commitment to the residents and taxpayers of the Town of Hingham” in conjunction with the proposed override in an effort to exercise fiscal discipline while continuing to provide quality municipal and educational services. The understanding is that another operating override would not be proposed until at least Fiscal 2028.

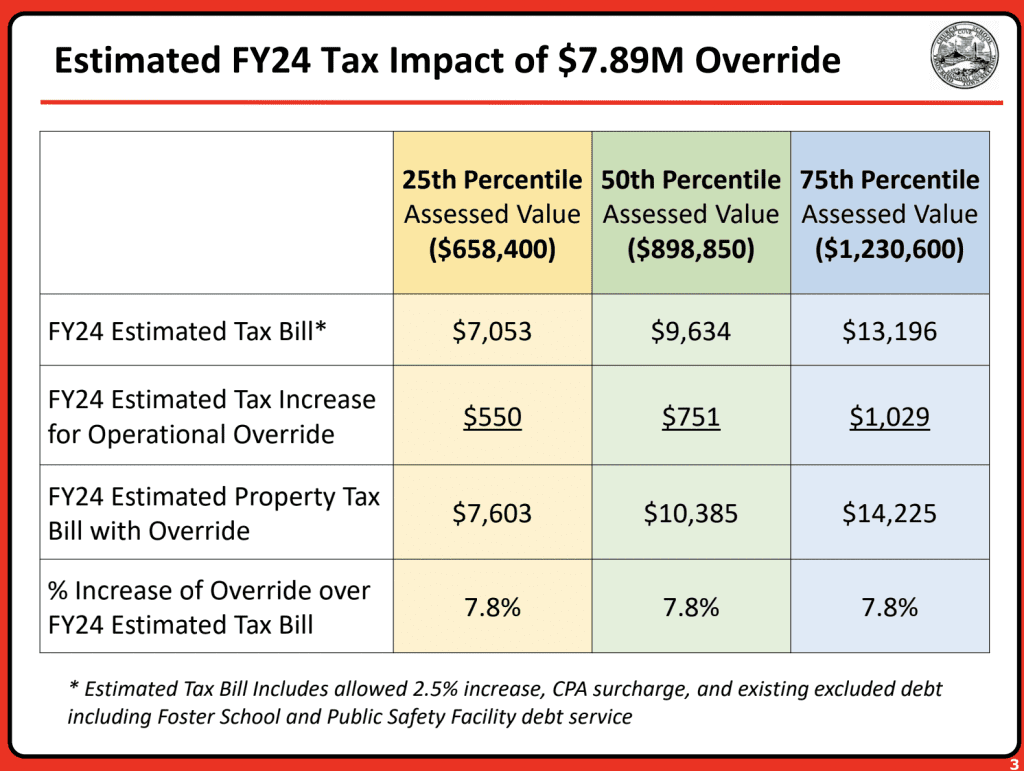

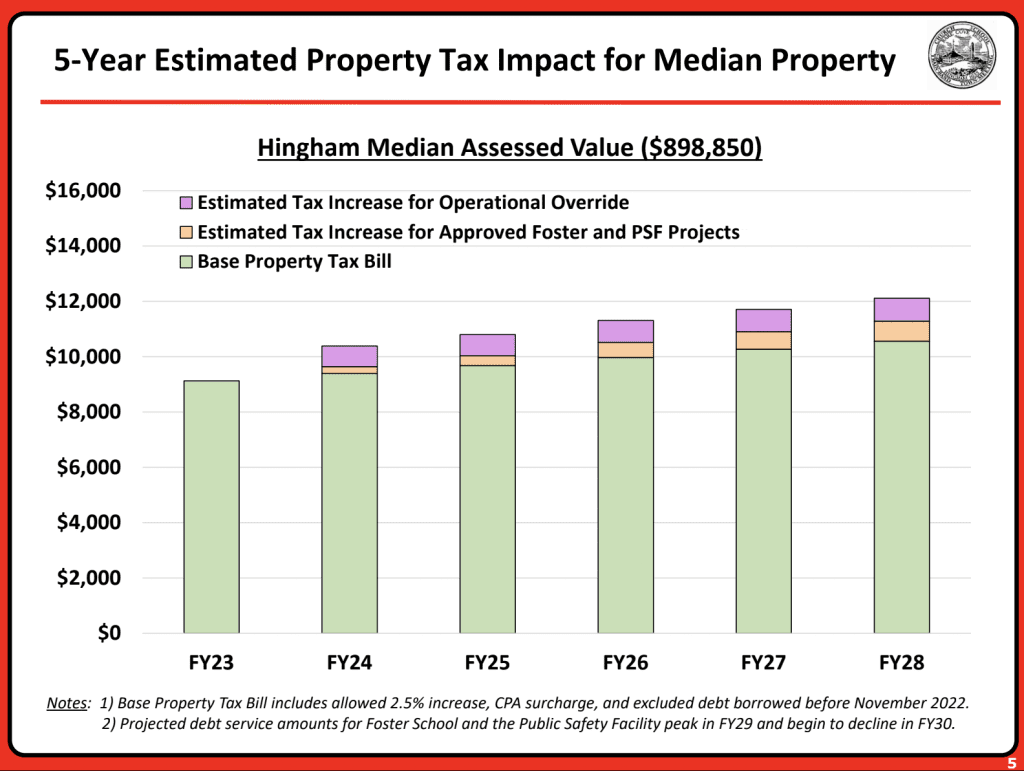

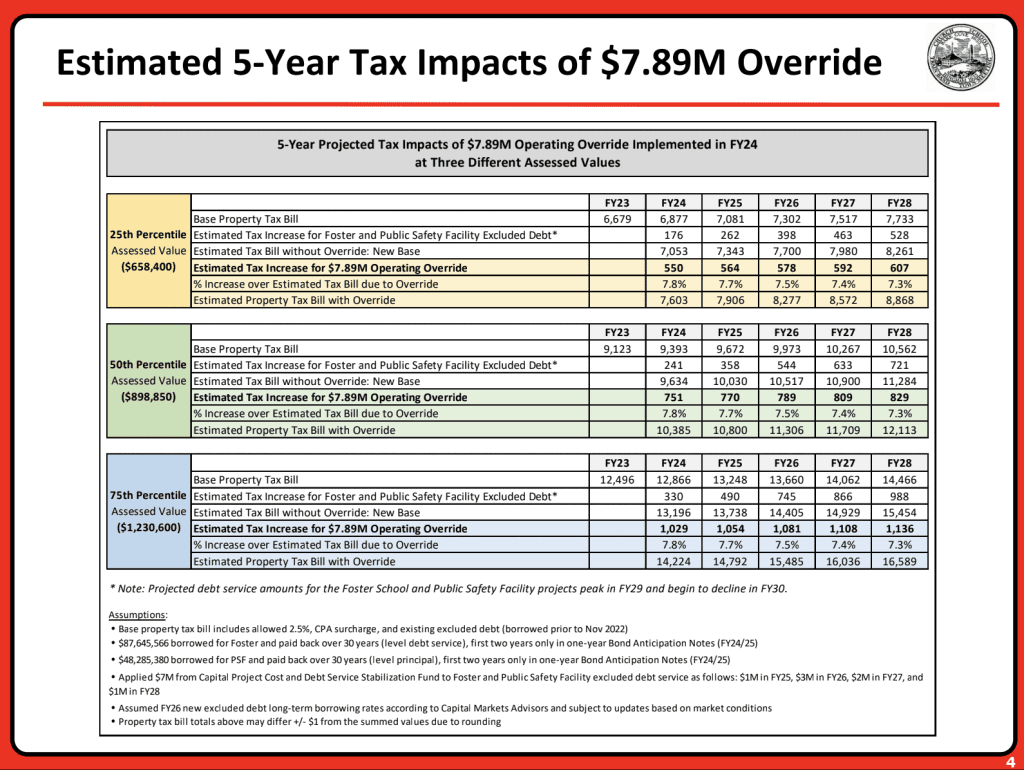

Monsegur shared a number of charts showing the projected estimated property tax impacts if the override passes, including one based on homes assessed at the 25th, 50th, and 75th percentile assessed value — $658,400, $898,850, and $1.2 million. Those figures include the Community Preservation Act surtax, the debt service for the new Foster School and public safety facility, among other factors. The new South Shore Country Club pool tax impact is not included because of the ongoing litigation involving neighbors opposed to the new facility.

In all three categories, the estimated tax increase for Fiscal 2024-2028 is 7.8 percent, 7.7 percent, 7.5 percent, 7.4 percent, and 7.3 percent, respectively — cumulative each year — if the override passes. (See the chart and footnotes that will be posted on the town website on Friday for further details.) A change in interest rates on the Foster and public safety facility projects would have an effect on the numbers.

An override tax impact estimator for FY2024 is also available on the town website.

The override question will appear on the ballot as follows: Shall the Town of Hingham be allowed to assess an additional $7,890,467 in real estate and personal property taxes for the purposes of funding the operating budgets of the Town and the Public Schools for the fiscal year beginning July 1, 2023.

Various tax relief exemptions and programs are available for qualifying residents which Monsegur said “could help offset the impact of the override” if it passes.

Select Board member Liz Klein said that while “the timing is not great for an override, and not everyone is in the financial position the graphs show, it’s important to look at the town as a whole.”

For further information about the override, including information sessions and informational videos, go to https://hingham-ma.gov/1025/Town-of-Hingham-FY24-Override. Watch for updates leading up to Town Meeting.

Email the Select Board at override@hingham-ma.gov with any questions or comments.