April 21, 2023 By Beth and Mark Rockoff

Advocates for the proposed $7.9 million tax override highlight many benefits that will occur for the town’s schools and municipal services if a majority of voters approve this request at the upcoming town meeting and subsequent town election. However, much less attention has been devoted to addressing the adverse consequences that will occur if this proposal passes.

In particular, those of limited means, including many retired senior citizens living on a fixed income, are already being challenged to keep up with rising costs due to inflation. This is even before they feel the effects of the tax increase approved last year for a new Foster School and Police/Fire Department Building, let alone the additional, large, permanent, property tax increase currently proposed. It is especially difficult for many long-time (or life-long) residents whose homes were purchased years ago when the price, and assessed value, was significantly less than now. Rising assessments and property tax bills are outpacing the ability for many to afford to remain in their homes.

Supporters of the override note several programs that currently exist in the town to assist those of limited means. But a close look at these options indicates they are cumbersome (and some would say demeaning) to apply for, do not permit many who need help to qualify, and even for those who do qualify, the extent of assistance provided is often inadequate. Essentially, while property taxes have been significantly increasing, abatement programs have not been keeping pace. Yet applications for assistance have been markedly increasing because more residents now need help.

Hingham is a beautiful town with excellent schools and municipal services. All residents desire it to remain that way. However, unless we want to see Hingham become a place where only the wealthy can afford to live, attention needs to be focused on more efficient utilization of available funds, as well as seeking sources of revenue beyond property taxes. Incidentally, it is worth noting that school enrollment has been decreasing for years while the number of school employees and school payroll has been increasing. Meanwhile, funding for schools still consumes 2/3 of the town’s increasing budget. Nevertheless, despite a request for additional school personnel, the school budget proposal does not even address the poverty-level wages currently being paid to the school’s paraprofessionals. Furthermore, there is no funding provided for a new or improved senior center, even though there are more senior citizens in the town now than there are children in the public schools. On top of all this, another tax override is projected to be necessary four years from now just to maintain “level services”. Is it appropriate to wait several more years before addressing the core issues here?

In conclusion, the town’s Financial Policy Statement that was approved a little more than a year ago lists seven principles to manage the town’s expenditures and financial resources. One of these is “to ensure that people of varied economic means remain part of our community”. Another is “to maintain stable tax rates”. In our opinion, these two important principles are not being adequately addressed. This is unfortunate since more of Hingham’s residents should not feel compelled to leave after they have, for many years, helped fund the town they care deeply about.

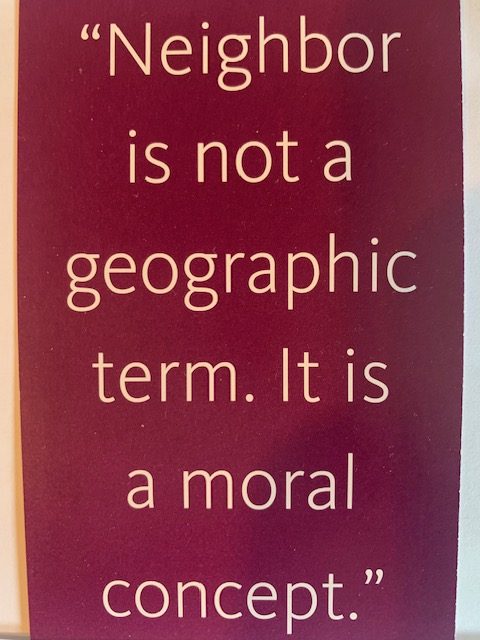

This is why many people are concerned about the large property tax increase currently proposed and troubled that a more modest option was not even offered as an alternative. Incidentally, similar issues recently arose in the town of Newton, and citizens there rejected a large property tax increase for many of the same reasons. Hopefully everyone in Hingham will consider all the implications of this current tax override proposal – and be respectful of individuals who express an opinion different from their own.

Totally agree. Thanks for putting it so clearly.

My wife and I are in our mid-seventies. We are on a fixed income. We’ve lived in Hingham for 35 years and had two kids educated in the Town’s excellent schools. I’d love to see my grandson to go to the new Foster School. We feel deeply that we have to give back. I have had the privilege of attending many meetings of Town committees over the past three years. The countless hours of uncompensated hard work and painstaking due diligence that our elected officials and scores of citizen volunteers invest in the governing of this Town is truly staggering and inspires my trust and confidence. Their recommendations mean a great deal to me. No one wants our older citizens to suffer financial hardship. This opinion piece suggests that an alarming number of them are at risk of losing their homes due to property taxes. The authors assert that “applications for assistance have been markedly increasing”. It would have been helpful if they had provided data on the extent to which tax abatement programs have been utilized during recent years. I asked that very question last year during a Select Board meeting and Town Administration staff helpfully came up with an answer for me real time: as of February 1, 2022, out of approximately a half million dollars set aside for these programs, only $21,000 had been expended! Only 25 people (out of around 3,475 residents over age 65) had applied for the means-tested senior abatement program; of those, 21 had been approved. (By the way, applications are confidential; they are not publicized.) This year, Social Security recipients received an 8.7% increase in benefits while Medicare B premiums stayed flat. Taken together, these numbers simply do not support the idea that we have an affordability crisis that is driving older folks out of their homes. Despite pious bloviation about “family values”, we have huge generational equity issues in this country. As a 75 year old, I am really tired of having my age cohort dragged out as the poster child for fiscal penuriousness. If an elder (I prefer this to being called a “senior” – unless I can call you a “junior”) is not getting the help they need, then contact the Town Administrator, or the Select Board – believe me, these are good people, they sincerely want to know about these kinds of situations and you can trust them to keep them confidential. Or write up a hardship story as a profile on an anonymous basis and let’s start dealing with actual cases we can learn from instead of ghosts. If there really is a problem, we won’t solve it by keeping people in the shadows.

My generation has doubled the carbon in the air during our adult lifetime, and the next generations are going to have to deal with the resultant weather extremes we are now seeing and know will only get worse. These kids just survived the worst pandemic in a century. Let’s at least give them the education they’ll need to cope with the climate and social adversity that lies ahead. The vast majority of peers that I talk to share my values and feel just as passionately about this as I do. Please join us in voting for the override. It’s only fair.

What a lovely, data driven, and heart felt response. Your addendum was also so kind. This is a great model for commentary.

Addendum: I did not want the anyone to think I was attributing “pious bloviation about family values” to the Rockoffs. Rather, I was referring to the general discourse in our current political climate. The Rockoffs are expressing valid concerns in good faith and I respect their opinions. I would not want anyone, most of all them, to think otherwise.

I have always been sad that Hingham kids can’t afford to live in the town they grew up in. Now, us senior Hingham kids will not be able to afford to live in the town we raised children in. I am upset that the total cost of “override” is kept separate. Folks, there are two overrides that will effectively be a 12% increase for us. Until a workable alternate solution is presented and developed I recommend a NO vote.