December 3, 2025 By Carol Britton Meyer

The select board voted to maintain a single tax rate for residential and commercial properties during the fiscal 2026 tax classification hearing Tuesday night.

This decision is in keeping with the town’s traditional approach to property taxes and was made upon the recommendation of the board of assessors in a joint meeting. A split tax rate would not increase revenue for the town.

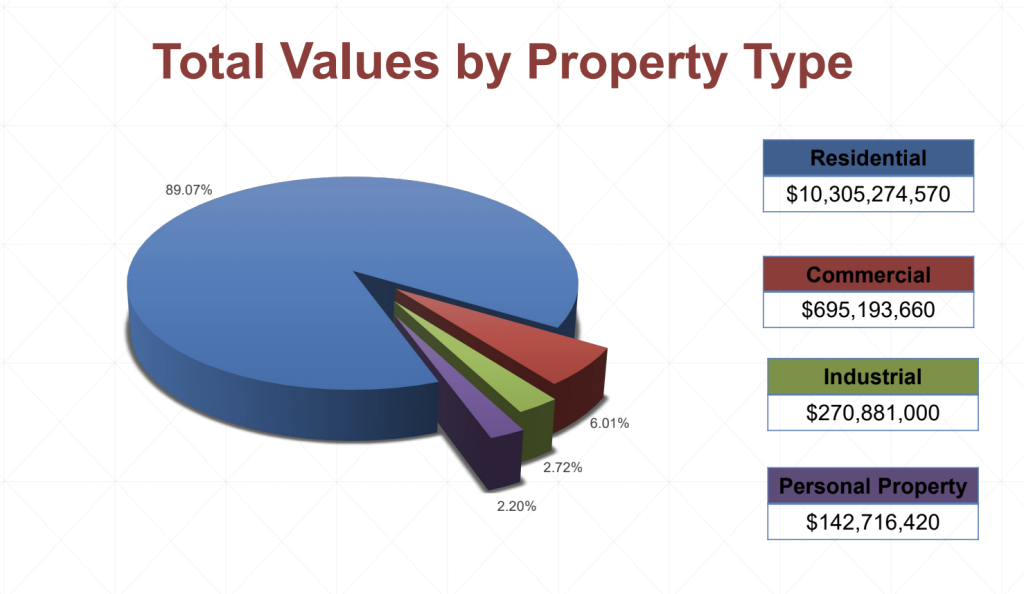

Because roughly 89% of the properties in town are residential, and Hingham has a small commercial base of about 6 percent, maintaining the single-rate structure means that most of the tax burden falls on residential property owners.

However, if the tax rate were split and commercial properties were charged a higher rate, homeowners would see relatively little savings, while the average commercial property owner would see his or her property tax burden greatly increase, depending on the percentage of the split.

Chair William Ramsey said he’s is particularly concerned about the impact a split rate would have on small businesses in the downtown area.

The estimated projected tax rate for fiscal 2026 is $10.32 per $1,000 of assessed value.

The current average assessed value for a single-family house is $1.37 million; condominium, $907,289; and commercial, industrial, and personal property, $1.35 million.

Property tax relief available for qualifying seniors

Also during the joint session, there was a reminder that longtime Hingham residents and property owners who are 65 and older and who qualified for the Massachusetts State Income Tax Refundable Credit known as the Circuit Breaker in calendar year 2024 — and who meet certain income and asset requirements — may qualify for the town’s Senior Means Tested Tax Exemption.

Outreach efforts continue to make qualifying residents aware of the program. This year’s deadline for submitting applications was Sept. 2.

Currently, 89 Hingham residents ages 65 and over (or co-owners ages 60 or older) are benefiting from the program.

Of those seniors, 10 are new applicants, and many others have qualified for this exemption for a number of years in a row.

For further information, call the Assessor’s Office at (781) 741-1455; email Assessors@hingham-ma.gov; stop by the Assessor’s office on the first floor of Town Hall; or go to https://www.hingham-ma.gov/909/Senior-Means-Tested-Tax-Exemption.

The staff there can walk citizens through the different tax relief programs that are available, including the Senior Means Tested Tax Exemption.