Fifth in a Series: Learning about the New Center for Active Living Project

November 10, 2025 by Glenn Mangurian

Summary

If you follow my Opinions for the Anchor, I prefer positive, educational and thought provoking essays. This Opinion essay discusses a framework for evaluating the impact of reducing the $210 median property tax increase associated with the proposed new Center for Active Living (CAL). It considers how a smaller tax increases than that which is proposed might affect building size. The framework does not identify the potentially significant reduction in program and service benefits to seniors for each reduced building size. Key observations include:

- Feedback from some residents—both seniors and non-seniors—indicates that the proposed $210 eight-year average median tax increase seems reasonable and represents good value for a 50-year investment.

- A 50-year facility will eventually service all current voters 18 years and older – current and future generations of seniors.

- The developed framework indicates alternative reductions in the proposed $210 median property tax cost would necessitate substantial reductions in CAL building size and elimination of numerous program rooms.

- The nominal tax savings from reducing the median increase appear small relative to the potential programs/services lost from a much smaller facility.

Note: This commentary reflects the author’s personal opinion and does not represent an official Town analysis.

Borrowing cost impacts on median property tax increases are based on communications with the Town Administrator’s Office regarding recent capital borrowing. The current assumption of $7.1 per $1 million borrowed on an 8-year average could decrease at offering time to reflect reductions in interest rates from Hingham’s most recent borrowing. The initial $210 8-year average will continue to decrease over the bond term. As a reminder, half residents will pay less than proposed $210 property tax increase and half will pay more.

Commentary

Feedback on the modest $210 median tax impact for the current proposed new CAL has been positive and is seen as a good 50-year investment.

Since I published (several weeks ago) my opinion on the tax impact for the proposed new CAL, I have heard from residents (seniors and non-seniors) that the modest $210 median tax increase is quite reasonable and worth the 50-year investment. Note: this project 50-year building life would support residents of current voting age today. I have talked to a few who have previously indicated that the building size and costs are too high but none have indicated what reduction in the $210 median tax increase they can support.

I developed a “reverse engineering” framework for considering smaller median tax increases.

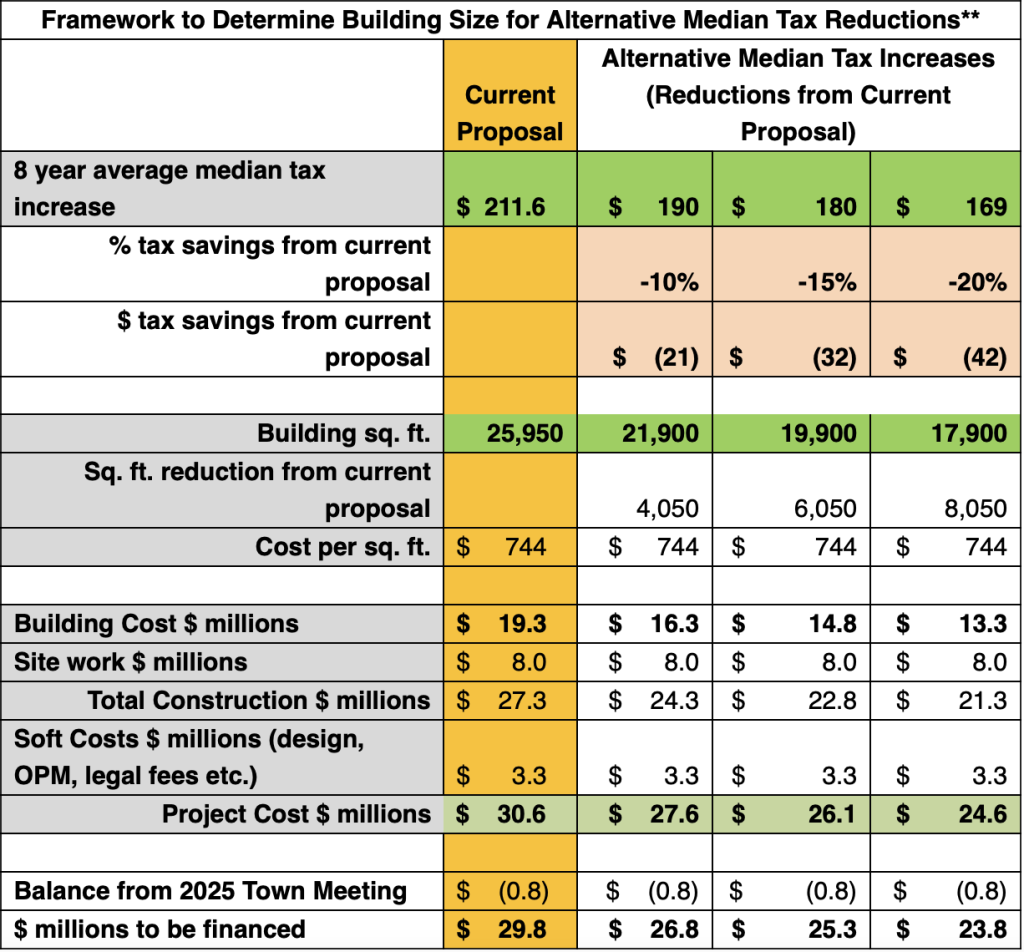

To assist those concerned about CAL cost and uncertain what building size and median property tax increase they can support, I developed a “reverse engineering” framework to help evaluate the trade-offs of reducing the $210 median property tax increase. I started by creating alternative scenarios reducing the CAL property tax increase by 10%, 15% and 20% from the current proposal and then worked backwards to determine the corresponding CAL building size. See chart below.

A small decrease in target property tax would require a substantial decrease in building square footage.The results indicate that even small decreases in median property tax would require significant reductions in building size from the current proposal. For example:

- A 10% reduction ($21 median tax savings) would require eliminating 4,050 sq. ft.

- A 20% reduction ($42 median tax savings) would require eliminating 8,050 sq. ft.

The 10% reduction (4,050 sq. ft. for a $21 median tax savings) could not be achieved by trimming the current proposed design. Rather, it would likely require elimination of numerous program rooms and a complete building redesign.

Remember: the current proposal already reflects a 10% reduction in building size from the original proposal. The framework assumes that site costs, soft costs (design fees, OPM fees, legal fees etc.) and building cost per sq. ft. remain constant. The per-square-foot cost for a smaller building could increase slightly. The OPM would need to determine whether those assumed fixed costs would potentially decrease slightly.

The nominal tax savings does not appear worth the likely benefits lost by reduced building square footage.

This is an important question. Reducing the building size would require a major redesign, updating bid documents, and receiving new vendor bids. The redesign would not be completed in time for the April 2026 Town Meeting resulting in a further delay and potentially increase facility construction costs. Before undertaking a redesign, the Select Board and Building Committee would need to determine if the nominal potential tax savings is worth the delay, additional design costs and potential higher constructions costs.

Final Comment: The $210 8-year average median tax increase for the current proposal still seems reasonable for the 50-year new CAL that will serve current and future generations of seniors. Steps to reduce the median tax increase would likely significantly risk building functionality and service benefits to seniors.

What do you think? I welcome your comments.

**Reverse Engineered Calculations

First Question: What $ tens millions to be financed will yield the alternative tax increase?

Alternative tax increase = $ tens millions to be financed x 71;

For example: $190 = $ tens millions to be financed x 71;

$ millions to be financed = $26.8

Second Question: What is the Building Cost?

$ millions to be financed ($26.8) = Site work $ millions ($8) + Soft costs $ millions ($3.3) + Balance from 2025 Town Meeting $ millions (-$.8) + Building cost $ millions

$26.8 = $8 + $3.3 – $.8 + Building cost

$16.3 = Building cost

Third Question: What sq. ft. x Cost per sq. ft. ($744) = Building cost $16.3 million to arrive at $26.8 million to be financed?

What sq. ft.? = $16.3/$744 = 21,900 sq. ft.

Glenn Mangurian is a Hingham resident of 42 years. He welcomes your comments and can be reached at gmangurian@comcast.net

Not all costs are represented here.

HCAL costs to the town of Hingham that will NOT be voted upon at 2026 Town Meeting include:

1. Fixing the traffic intersection at Fort Hill/Bare Cove, including paying police to direct traffic;

2. Bringing a water main to the senior center, as well as installing a fire hydrant nearby. (Also, possibly to the model train station,

athletic fields and pickleball court for restrooms);

3. Fixing and repaving Bare Cove Park Drive;

4. Redrawing all the traffic and parking lines.

Environmental costs have not been included at all. Humans will suffer from:

5. Increase in temperature due to foliage loss and installation of asphalt;

6. Erosion of soil due to reduced foliage and roots;

7. More flooding due to weaker stormwater management;

8. Loss of wildlife, including rare species, due to habitat loss and noise;

9. Increased noise due to construction and loss of buffer trees between BCP and Beal Street

10. Loss of natural space, a source of psychological and mental well-being.

Many on-going costs have been deliberately underestimated or omitted:

11. The same staff plus one janitor cannot support a greatly enlarged program, modeled after Marshfield’s.

12. A gardener (or Garden Club) will be needed after the 1 year landscaping warranty is up.

13. The DPW must provide free on-going support, including plowing and mowing.

14. Increased security will be needed in such an isolated place.

15. Lights are needed, that do not interfere with wildlife. Birds travel at night.

The new HCAL has been underfunded and oversold:

14. Images, such as active people playing pickleball and 6-inch diameter-at-breast-height deciduous trees, oversell the offerings.

15. Several amenities in the original designs have been deleted to lower costs.

16. Fundraising is planned to cover up shortfalls in the funding.

17. Permitting has not kept up with planning.

Do the benefits of HCAL outweigh all the costs when we count environmental and operating costs, not just initial construction costs?