October 27, 2025 by Glenn Mangurian

Fourth in a Series: Learning about the New Center for Active Living ProjectSummary

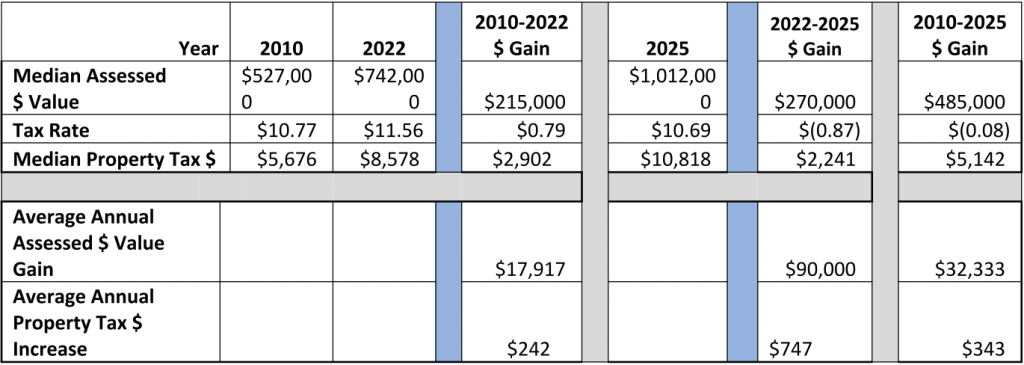

This Opinion essay is a commentary related to the deferred needs from the 2010 decade and the implications on median property taxes and median assessed value from 2010 to 2025. Here are my key findings.

- The 2010 decade (and up until 2022) was a time of tightly managed property taxes and with no capital borrowing or operating overrides.

- A number of important investments were deferred into the 2020 decade and beyond.

- Over the last three years some deferred investments (the new Foster School, the new Public Safety building and the County Club swimming pool) were approved increasing taxes over a short period.

- Over the same three years property values have skyrocketed increasing by $270,000 for median assessed property and created affordability issues for new home buyers.

- When viewed over the fifteen years (2010 to 2025), however, median property taxes have increased an average of only $343 per year but the median property value increased significantly by $485,000 or an average of $32,333 per year.

- Additional capital investments proposals are on the horizon and will likely be evaluated over the next 10 to 15 years (depending upon State and Federal aid approval processes).

- The new Hingham Center for Active Living has moved to be next in line and will likely have only a modest impact (increase of $210 or less) on the median property taxes.

- HCAL staff or Assessor’s Office staff are eager to help find the tax relief programs (and relevant Federal aid) best suited to the needs of Hingham’s financially challenged home owners.

The remainder of this Opinion essay analyzes and compares median assessment and property tax data over three time periods: 2010-2022 (12 years), 2022-2025 (3 years) and 2010-2025 (15 years).

*This tax and property value commentary is the opinion of the author and does not represent an official Town document. The source of tax rate, actual median property tax and median property values: Hingham Assessors website and email communication with Erin Delaney, Director of Assessing.

Commentary

Last month I wrote that the current proposed new Hingham Center for Active Living (HCAL) could increase the median property tax by an 8 year average of $210. Several residents have commented that the HCAL building project is only one of several other capital projects that will be needed. I wanted to understand why so many potential investments are on the horizon. Here is what I discovered.

The 2010 Decade Was a Time of Tightly Managed Property Taxes. See chart below.

I went back to 2010 and discovered that there were no capital projects or operating budget overrides until 2022. Evidently, town leaders at the time put a priority of managing property tax increases. During that 12 year period the median property taxes increased by an average of only $241 per year. During the same time period the median assessed property value increased by $215,000 or an annual average of $17,916. The relatively low property tax increases, while welcomed by home owners, had consequences.

A number of important capital investments were deferred into the 2020 decade.

Starting in 2022 to 2025, Hingham approved several deferred investments from the previous decade. These include increased hiring for the schools, the new Foster School, the new Public Safety building and the County Club swimming pool. During the 2022-2025 period median property taxes increased at a faster rate than the 2010 decade and so did the median property values.

Over the same three years median property values have skyrocketed increasing by $270,000 and created affordability issues for new home buyers.

At a recent joint meeting with the Select Board and the Advisory Committee, Joshua Ross commented on the rapid growth in Hingham property values. My investigation found that the median average annual property tax $ increase jumped from $241 (over 12 years) to $747 (over the past three years). I checked to learn what happened to the median assessed property values over the same three year period. In fact, the median property values increased $270,000 in just three years. All of our homes became much more valuable. That gain in property values benefited current home owners but created affordability challenges to potential purchasers hoping to join the Hingham community. When people comment that Hingham has become unaffordable, they are referring to residential purchase price. Today, the median assessed property value is $1,012,000 – half owners are less and half are more.

Over the past 15 Years Median Property Taxes Have Increased an Average Only $343 per Year and the Average Median Property Value Increase a total of $485,000.

Since 2010, Hingham tax rates have remained stable with a slight decrease of -$.08. The FY25 rate is $10.69 per $1,000 of assessed value. As a result, most of the median property tax increases are driven by gains in property values. Hingham’s median assessed property values have increased $485,000 or an average of $32,333 annually since 2010. Given the limited supply of residential inventory, it is fair to assume that demand will continue to drive real estate values up.

Additional capital investments proposals are on the horizon and will likely be evaluated over the next 10 to 15 years (depending upon State and Federal aid approval processes).

AdCom is cognizant that there are deferred investments from 2010 to 2022 and new investments that our Town Meeting will need to consider over the next fifteen years. Some of these capital investments will be eligible for State MSBA grants and Federal aid thereby reducing the borrowing requirement. The new HCAL is next in line. The timing and spacing of future capital investment proposals is uncertain given the deliberate approval processes for State and Federal aid bureaucracies. Each investment will be evaluated on its own merits and at Town Meeting.

The new Hingham Center for Active Living has moved to be next in line and will likely have only a modest impact (increase of $210 or less) on the median property taxes.

The 8 year average of $210 investment for the new HCAL is less than the twelve year average (2010-22) of $241. It is substantially less than the fifteen year average of $343. As I wrote last month, there may be a few who cannot afford the $210 increase. I want to repeat that Hingham has nine tax relief programs available to qualified residents. HCAL staff or Assessor’s Office staff are eager to help find the programs best suited to the needs of financially challenged home owners. The $210 (or less) median tax increase seems reasonable when looked at in the context of historical spending and over the fifteen year time horizon.

What do you think?

Data Analysis: Year 2010-25 Median Assessed Value Increase to Median Property Tax Increase

Opinion Correction Regarding Deferred Investments

Earlier this week I made an error in reporting that there was no capital borrowing during the 2010 decade. See post above. In fact, there were two important capital investments. First, in 2011, a Special Town Meeting authorized $60.9 million for the construction of a new Middle School. I remember the Middle School roof collapse increased the urgency of constructing a new school. The construction began in June of 2013 and the school opened for students in September of 2014. After the MSBA subsidy, I believe the Town borrowed $32 million in May 2015 and that debt will be paid off in 2037. That $32 million borrowing did increase the property taxes and that increase is reflected in the median tax increase that the Assessor’s Office provided me. Second, in 2019 the Town Meeting borrowed $115 million to buy the water system. The debt payments do not affect property taxes but rather are being assumed by rate payers in the form of increased usage rates. I apologize for overlooking these important investments made in the 2010 decade.

My understanding of the PRS windows is that a MSBA grant paid for a good portion of the project and other sources were applied so as to not affect property taxes. I don’t know about the Snack Shack or pathway to bathing beach. The Pickle Ball courts were approved in this decade after the median property taxes and property value increases communicated from the Assessor’s Office and referenced in my Opinion. I believe that no actual borrowing has taken place for the swimming pool yet.

The median property tax increases and median property assessment gains remain as reported for the three periods (2010-22, 2022-25 and 2010-2025) in the Opinion and were from the Assessor’s Office. The conclusion remains the same. When viewed over the fifteen years (2010 to 2025) median property taxes have increased an average of only $343 per year (including the borrowing referenced above and in my Opinion post as well as the operating override of this decade) but the median property value increased significantly by $485,000 or an average of $32,333 per year.

I believe that the Hingham capital process is to evaluate each project on its own merits as they are presented to Town Meeting. This has been true for past projects and recent projects such as the Foster School, Public Safety building, Swimming Pool and even Pickle Ball courts. I expect the same process to be used to evaluate the property tax increase and benefits of the new CAL as well as future capital projects.

I continue to respect our volunteer town leaders who have managed our finances prudently while continuing to invest in Hingham. Those decisions have contributed to maintaining our very high AAA bond rating, significant median property value gains and relatively low tax rate.

This piece stands out for its rational, evidence-based approach—linking property tax and valuation trends over time to inform responsible decision-making. Thank you.